Debunking The Very Best Myths About Your Credit Score

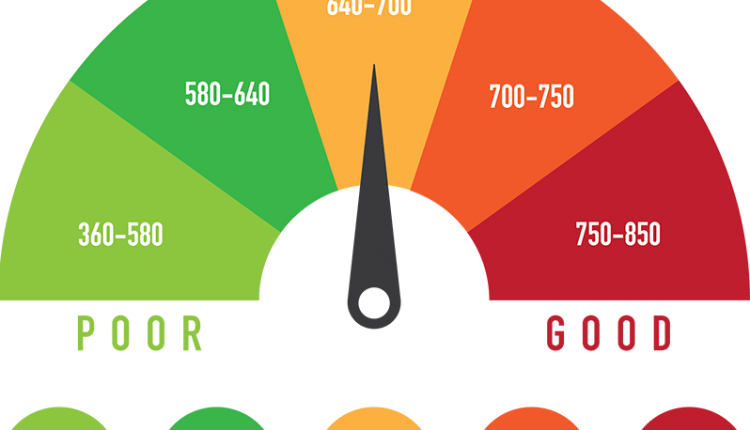

Thinking about how valuable your credit score as well as your resulting credit rating will be to you, it never ceases to amaze me the number of people have confidence in and depend on misconceptions, myths, and downright bunk about how exactly credit rating works. To adequately function in the current society, a person’s credit rating must be a minimum of in the “ok” level, and individuals with poor credit or a bad credit score are just speeding up their volitile manner by not doing something about this.

The sad part is there are steps you can take to raise your credit score. While individuals things take effort, they don’t always require money and all of these are steps you can take in your own home.

Most people don’t realize they have three entirely separate and distinct credit history, one from each one of the three credit rating bureaus. As these bureaus don’t share information, both report the things they think they are fully aware, which the truth is implies that undertake and don’t includes a true and finish picture of the credit. To include insult to injuries, odds are very high that your credit score with a minumum of one (if not completely) from the credit agencies contains errors, and the only method the errors can get fixed and removed is that if YOU dispute them. I have come across people whose credit rating leaped greater than 100 points in under per month once they got various inaccurate information taken off their credit profile.

But let us spend time here speaking about some common myths about credit, credit ratings, and credit rating, and discover what the real thing is about this misconceptions.

Myth #1: Having to pay off an adverse account on your credit score can get it taken off your report.

This isn’t true whatsoever. That account will stay on your credit score for a long time, plainly showing for those to determine it went overdue, it went delinquent, and you compensated them back. But as it is part of your credit report, it stays on your credit report for a long time. Remember, your credit report is precisely that – past your dealings with credit, and merely because a free account is closed or compensated off doesn’t dismiss the truth that it’s still a part of your credit report.

Myth #2: Having to pay off a free account may cause your credit rating to improve considerably.

Again not the case. You will find a large number of factors that come up once the credit agencies calculate your credit rating. Chief among individuals factors are are you currently having to pay your obligations promptly with a minimum of the minimum payment due. Having to pay off a free account entirely can really do more damage than good. Getting credit up to date, but keeping the balance under about 32% of the borrowing limit is a superb spot to be, and also you gain no additional points by having to pay off that account.

Myth #3: Checking your credit history will lower your credit rating.

All over again not the case. The financially savvy consumer will check his credit history at least one time annually, sometimes more frequently. Each time someone demands a duplicate of your credit score, this is flagged, but it’s also flagged regarding WHO requested your credit score. Whether it was you, it does absolutely nothing to your credit rating, instead of getting your credit score requested by 12 different loan providers, that is almost certain to raise a warning sign minimizing your score.

Myth #4: Cosigning for a financial loan does not necessarily mean you have the effect of the account.

By no means true. The main reason you had been requested to co-sign up financing or perhaps an take into account someone is they themselves have inadequate credit rating and have poor credit history. The action of you co-signing on you telling the lending company “hey, when they default about this, I’ll take proper care of it”, so you have responsibility for that loan. However it will get worse – if the one who required the loan begins to default onto it, then it’s also Your credit rating that suffers, since again, you co-signed onto it, providing you with some responsibility to make sure they pay back it promptly.

Comments are closed.